With markets falling and inflation ramping up, investors might feel they need to ‘do something’ to avoid further losses. However, when it comes to investing, taking action in response to market turmoil may derail a sound investment strategy.

To say that conditions have changed since the initial 2022 outlook would be an understatement.

We welcomed the year with expectations that global economies would continue to recover from the impacts of the COVID-19 pandemic albeit at a more modest pace in comparison to 2021.

But while that continues to hold true, the pace of change in macroeconomic fundamentals such as inflation, growth, and monetary policy has failed to live up to expectations.

What we expect the RBA will do to control inflation

Labour and supply-chain constraints were already fuelling inflation before the year began, but Russia’s invasion of Ukraine and China’s zero-COVID policy have exacerbated the situation.

The RBA has raised the cash rate several times now, faster than anticipated, in an attempt to stay ahead of the race against inflation. However, inflation remains well above what was forecast and will take time to fall back to the RBA’s 2-3% target.

Nonetheless, the sense of urgency remains, and the RBA has signalled further increases will likely be required to address the issue. We expect the cash rate to rise to at least 2.5% by the end of this year and for inflation to peak around 7%.

But the central bank’s actions must be considered alongside the risk of cooling the economy to the point that Australia enters a recession. It is possible that Australia will enter a recession before inflation falls back to target. That said, the chances of a recession are lower in Australia than other developed economies because as a commodities exporter, Australia stands to benefit from higher commodity prices, which will help offset weakness in other parts of the economy.

Fixed income and equity markets have been hit hard, but there’s a silver lining

As a consequence of a rising interest rates and a deteriorating economic backdrop, fixed income and equity markets have been hit hard so far in 2022, keeping many investors on edge. But there is a silver lining to down markets. Because of lower current equity market valuations and higher interest rates, our analysis is now projecting slightly higher long-term returns in comparison to previous modelling.

Our 10-year annualised return forecasts for global equity markets are largely 1.5 percentage points higher than at the end of 2021. And in good news for bond investors, our fixed income return forecasts in many regions are 1.5 percentage points higher. Rising yields may detract from current prices of bonds, but that means higher returns in the future as interest payments are reinvested in higher-interest bonds.

Tip for investors: focus on time in market, not market timing

With markets falling and inflation ramping up, investors might feel they need to ‘do something’ to avoid further losses. However, when it comes to investments, taking action in response to market turmoil may be detrimental to long-term objectives and derail a sound investment strategy.

History can also help put many of today’s challenges into perspective. For example, the heightened volatility we are experiencing currently is far from unusual.

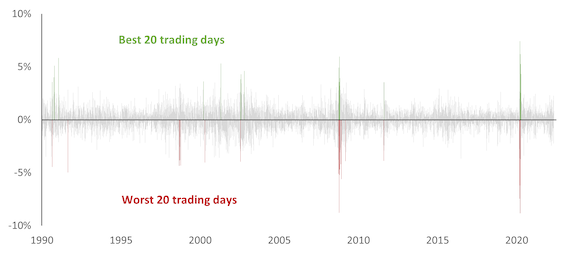

The chart below shows the volatility and price return of the MSCI All Country World Index. It illustrates that volatility is a constant factor that tends to spike when equity markets endure a severe downturn. However, the inevitable troughs that investors will experience over time often give way to higher peaks.

History of volatility and long-term gain

Notes: The chart shows the daily price return to the MSCI All Country World Index in AUD, with the best and worst 20 days by price return highlighted.

Source: Vanguard calculations, using data from Bloomberg from 1 January 1988 to 30 June 2022.

Moreover, the best and worst trading days often occur close together and irrespective of the overall market performance for that year. The data from the last three decades has a clear message for investors – even a bad year for markets can deliver some of the best single-day returns an investor will experience in their lifetime.

For this very reason, investors should continue to invest to build up their long-term wealth, such as for retirement. An investor’s long-term goals, as per the four principles for investing success (set your long-term goals, follow a balanced strategy, maintain discipline and keep investment costs low), should always be forefront of mind when it comes to portfolio decisions.

If you have any questions about your current investment strategy, contact us on (08) 8362 4555.

Source: Vanguard

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.